Commentary – Year ended 30 June 2024

Investment Strategy

We are required to invest the Fund on a prudent and commercial basis. In so doing, our investment objective is to maximise returns without undue risk to the Fund as a whole, while managing and administering the Fund in a manner consistent with best practice portfolio management.

We define this objective as being to maximise the Fund’s returns over and above New Zealand Government Bonds (before New Zealand tax), while limiting the chance of under-performing New Zealand Government Bonds over rolling ten-year periods.

We rely largely on equities to achieve Fund returns greater than New Zealand Government Bonds because, economically and historically, equities are the most reliable source of excess returns over longer time horizons.

We use a notional Reference Portfolio to measure the additional risk and to benchmark the Fund’s performance over interim periods.

The Reference Portfolio is a simple, globally diversified portfolio that we expect to meet our long-term investment objective by investing passively in liquid public equity and bond markets at low cost. The Reference Portfolio comprises 70% global equities, 10% New Zealand equities and 20% global fixed income securities. We invest about 90% of the Fund internationally to avoid concentration of risk in New Zealand assets. Foreign currency exposure is 20% of the Fund on average over time.

To add value, against the Reference Portfolio, without increasing the overall volatility of returns, we invest the Fund in private equities and insurance-linked assets that offer a diversified return source. We seek additional returns through active management of most asset classes. We also dynamically tilt the Fund towards cheaper asset classes and away from more expensive ones, because we believe this pays off over longer periods.

We benchmark all investment decisions against the Reference Portfolio to assess whether they add value in terms of higher returns for equivalent risk, net of investment management fees.

We manage the Fund to have similar risk to the Reference Portfolio whilst being more diversified. When global equities rise strongly, the Fund may underperform the Reference Portfolio but is more likely to outperform bonds, which is the primary goal.

We expect the Reference Portfolio to outperform New Zealand Government Bonds by 2.2% pa over the next ten years. That compares with 3.1% pa since the Fund’s inception and 6.2% pa over the last decade.

Chart 1 sets out the Fund’s asset allocation at 30 June 2024, compared with the Reference Portfolio.

/2024-asset-allocation.png)

Investment Returns

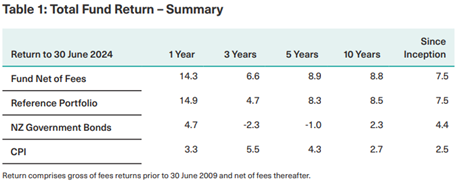

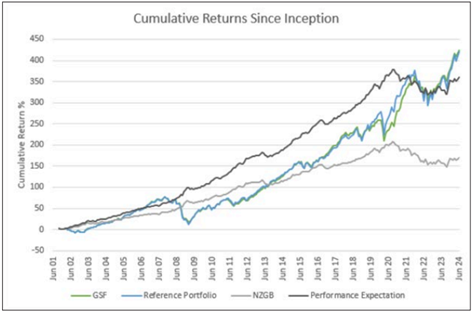

The Fund returned 14.3% in the year to 30 June 2024, net of investment management fees and before tax, far in excess of the 4.7% return of New Zealand Government Bonds but lagging 0.6% behind the Reference Portfolio.

Despite the relative performance in this financial year, the Fund’s returns are comfortably ahead of the Reference Portfolio over the last 3 and 5 years. We aim to add 0.8% p.a. on average over ten-year periods from alternative return sources, active managers and the strategic tilting programme. Added value in the last ten years was 0.3% p.a. over the Reference Portfolio so fell someway short of our long-term target.

During the year, active managers of global listed equities and bonds contributed positively to the Fund, outperforming their benchmarks. However, the Fund’s global private equity investments detracted material value relative to the Reference Portfolio. In large part this is due to the private markets not having exposure to the surging AI-related listed equities that drove the public markets higher. The Fund’s investment in alternative assets, such as insurance-linked securities were also strong contributors this year, significantly outperforming their funding sources (refer Table 2).

Chart 2: Cumulative Returns since October 2001

Chart 2 below shows the cumulative returns for the Fund since inception in October 2001. The Fund’s long-term return has climbed back from its 2008 trough and is now above its long term expected level relative to New Zealand Government Bonds.

Returns by Asset Class

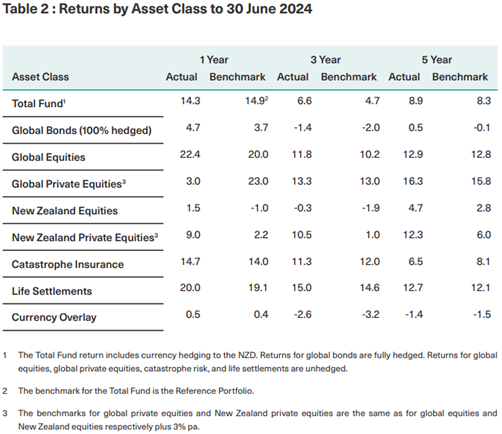

Table 2 shows the investment returns by major asset class compared to the relevant asset class benchmark. All returns are annualised, in New Zealand dollars (NZD) before New Zealand tax and after investment management fees.